How To Pick Pairs For Crypto Grid Bots

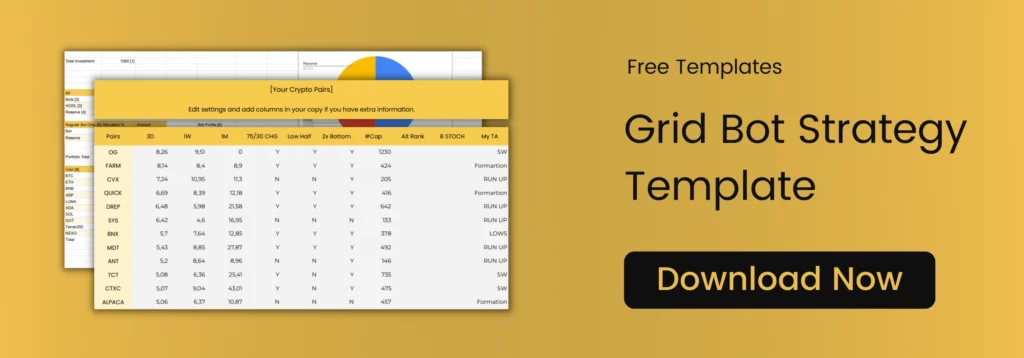

Get your crypto grid bot template right now.

Why Research Pairs

Crypto grid bots offer a powerful tool for automating and optimizing your trading strategies. These bots provide suggested trading pairs with predetermined settings, delivering consistent profits.

However, to truly unlock the potential of your grid bot and maximize profits while minimizing risks, it's crucial to learn how to select the best pairs tailored to specific market conditions and times.

There are other types of crypto trading bots that may be effective but grid bots are quite interestign due to it's flexibility and how they can be used for multiple market condition.

In this post I'm going to share some invaluable insights and guidance on how to identify the most promising pairs for your crypto grid bots.

Backtesting Results

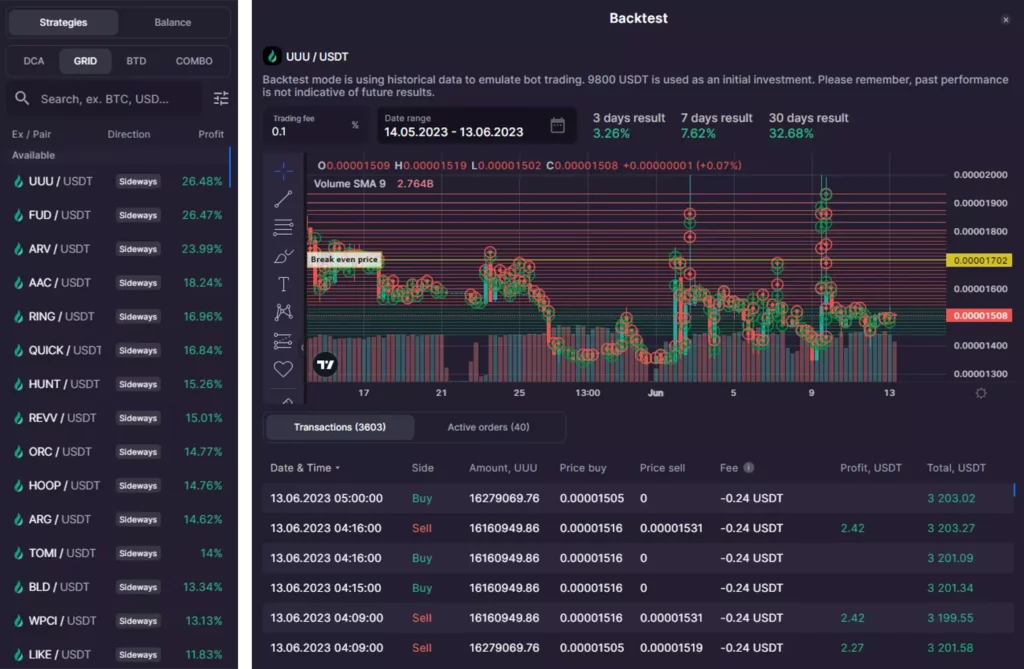

To begin, if you're using Bitsgap, the platform recommends pairs based on backtesting results from different time frames, such as three days, one week, and one month. These suggestions serve as an excellent starting point.

It's important to note that other platforms like KuCoin, BitUniverse or Pionex may only provide the overall percentage of returns for specific pairs.

Crypto Market Data

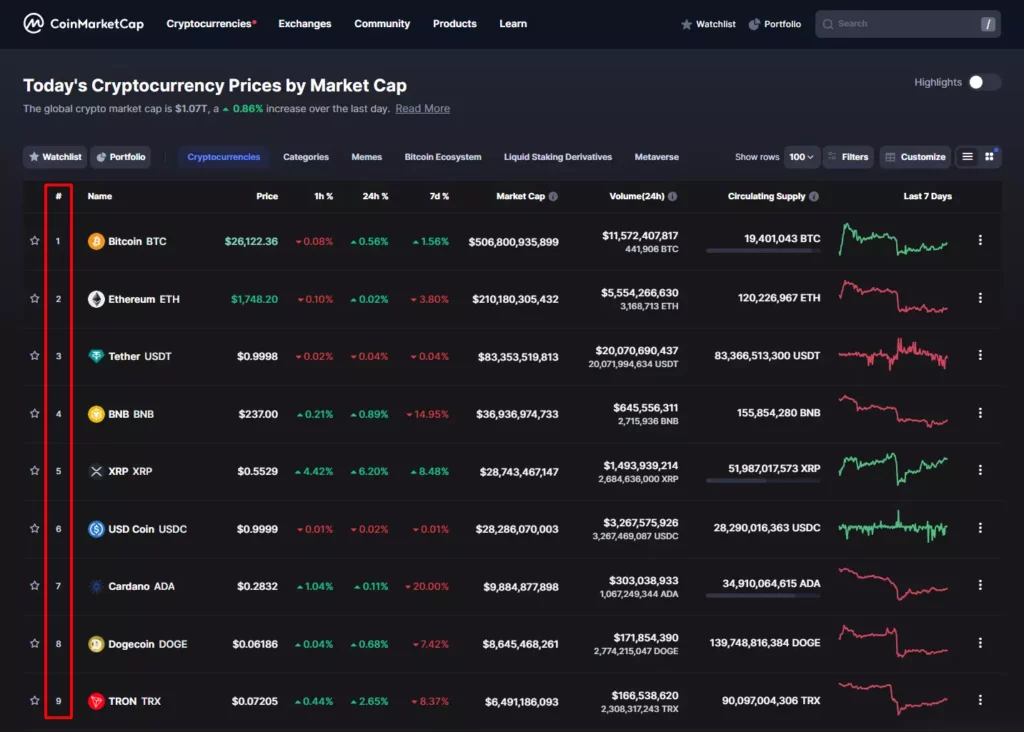

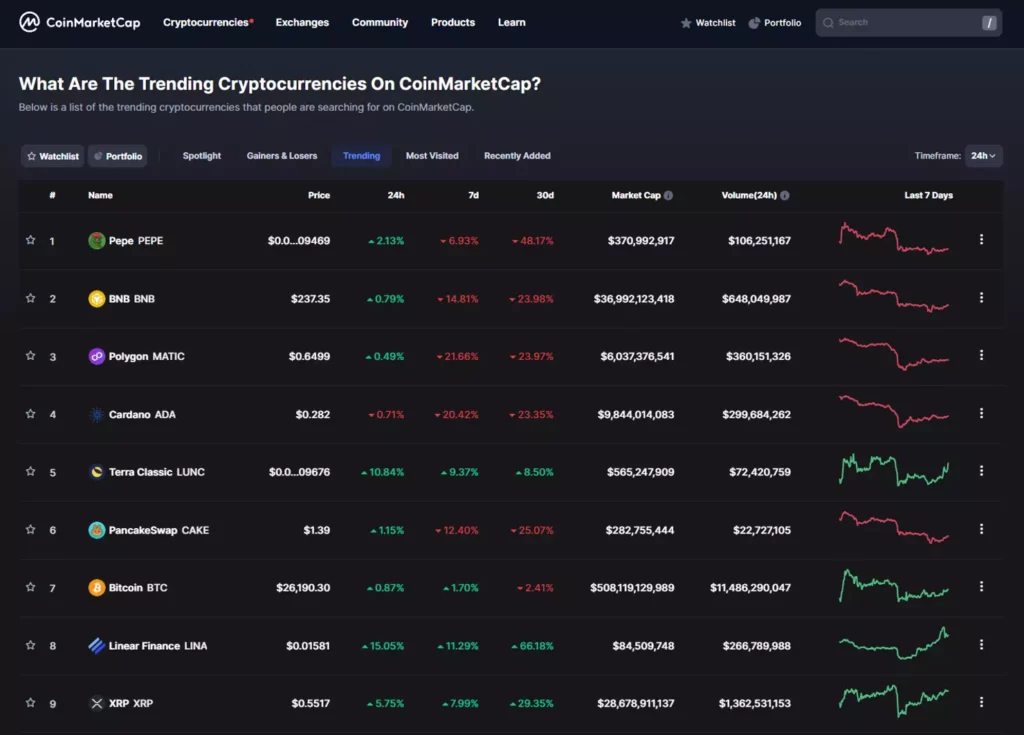

To gain a comprehensive understanding of the global market sentiment, crypto market data sites like Coin Market Cap or Coin Gecko prove invaluable.

These platforms allow you to explore a vast array of coins, filter them by various metrics such as volume or market cap, and even assess the liquidity and risk associated with each coin.

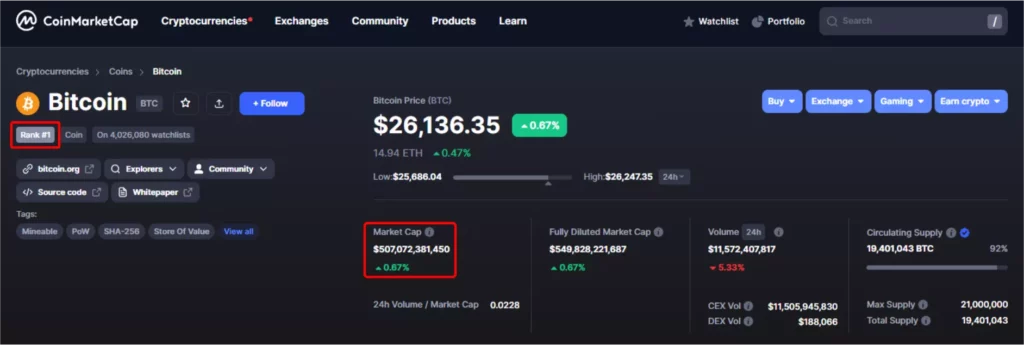

Market Cap & Risk

By looking at the market cap rank or number you can gauge the risk level of trading a certain coin or pair.

Market cap, denoted by a hashtag or # followed by a number (#100), serves as a crucial indicator. Generally, higher market cap implies lower risk, while lower market cap coins present both risks and potential opportunities.

Here's an example of how I look at it: coins within the top 100 market cap for the least risk, followed by the range of 100 to 500 for moderate risk. Coins with market caps ranging from 500 to 1000 are considered higher risk, and anything above 1000 falls under the category of significantly higher risk.

For optimal risk management, I typically trade pairs with market caps between 100 and 600 or 700 at the most.

Trending Coins

When exploring trending categories or themes in the crypto market, you can expect to generate faster profits by selecting pairs associated with these trends. While not foolproof, this strategy can prove highly effective, especially when capitalizing on the surge of a trending coin.

Platforms like Coin Market Cap's categories page or Lunar Crash provide valuable insights into trending patterns. Social media platforms like Twitter can also be used for that purpose, with hashtags and trending sections serving as indicators of emerging opportunities.

For those inclined towards fundamental analysis, staying informed through news sources can offer valuable insights. However, if you prefer a hassle-free approach, following Coin Gecko on Instagram can provide you with the top trending coins in specific countries.

Do Your Own Research (DYOR)

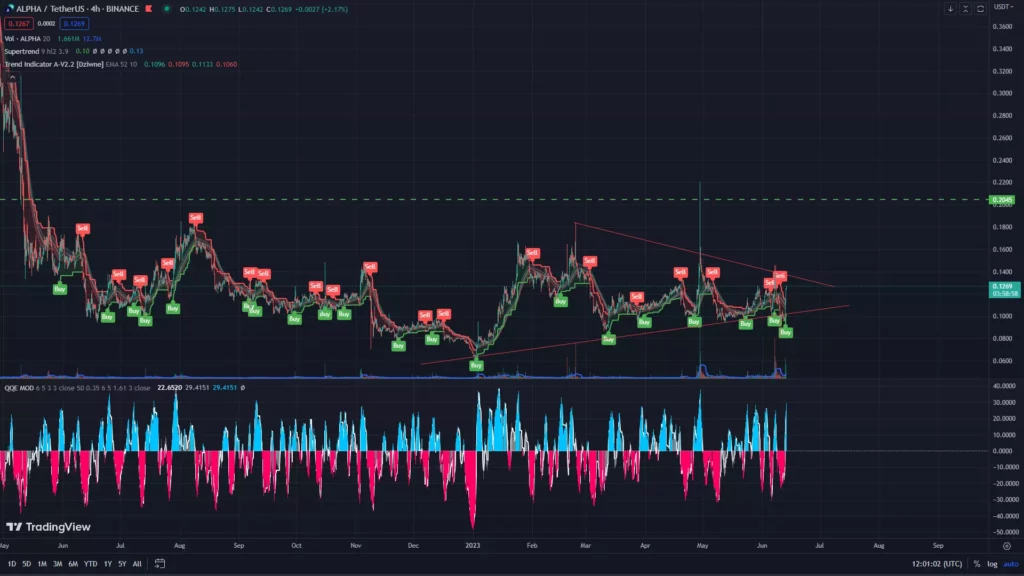

While picking pairs may seem straightforward, it's important never to neglect your own research. Examining charts on platforms like TradingView can help you assess price action, indicators, and patterns. These tools enable you to gauge the suitability of a pair for your bot. However, when running bots for the medium to long term, it's crucial to anticipate fluctuations along the way.

Timing your bot's initiation is crucial, but not every pair displaying favorable signals should be included on your desired pair list. Remember, your bot operates according to the market trend, allowing you to generate profits in both upward and downward market movements.

If you want to determine the best time to start your bot, there's another post on the blog which delves deeper into this topic.

You can also download the grid bot template down bellow! This template facilitates your pair selection process, resource allocation, and capital management. It ensures a streamlined approach to managing your grid bot operations.