5 Best Crypto Grid Bots [And Which Is The Best For You]

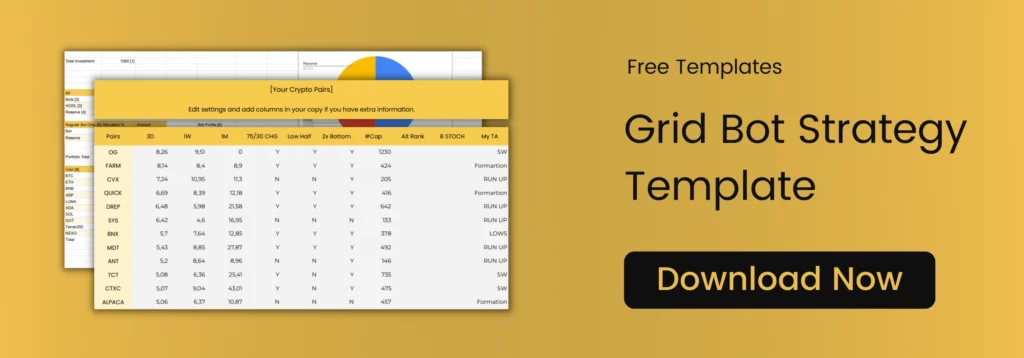

Get your crypto grid bot template right now.

Introduction

With so much crypto trading bots and automated strategies out there, it can get confusing or hard to pick the best for yourself.

Especially if you are a beginner to crypto trading automation or just a new crypto investor who is looking to make some profits without putting in a lot of hours to trade or frantically monitor your portfolio going up and down.

This post will help you choose the best crypto grid bot to generate some passive income or just increase your portfolio value.

We will provide 5 examples of crypto grid trading bots that we deem as the best or most used according to different use cases or the stage of your investing/ trading journey.

So don’t worry if you have X amount of Dollars or X amount of experience, there will be something for you here, so keep on reading!

Why are Crypto Grid Bots Important?

To put it simply, crypto grid bots are automation programs that buy low and sell high in a specific price range.

The way they work is that they will place multiple buy and sell orders on the price range creating a grid of orders based on a fixed price (right in the middle of the grids). Allowing you to profit off small price fluctuations and overall market volatility.

It’s a great way to avoid emotional trades and make profits especially in bull and sideways markets. The strategy can still be profitable on bearish markets if you have a firm hand and a plan to allocate funds properly.

By using these bots you can not only make profits from volatility, but also take advantage of price increases (or capital gains).

I’m not going to throw BS at you or say it’s all sunshine and rainbows, but provided that market conditions and settings meet somewhere in the middle, you will have a great time with these virtual cash machines.

5 Best Crypto Grid Bots

Bitsgap [best overall]

Bitsgap is the most expensive on the list with a fixed monthly subscription, but also the best overall.

Their backtesting functionality is one of the best if not the best of all the bots mentioned. Not just due to its accuracy but also their recommended strategies feature.

Using the “recommended strategies” section saves a ton of time and will present you with very good pairs out of the bat, that you can look into further to optimize your bots.

Those recommended strategies and pairs will display a profit percentage (results based on standard settings) for a certain time frame such as 3 days, 1 week or 1 month.

But if there is not a particular strategy you think will perform well at the moment, you can still run the backtesting tool for any of your own specific set of settings for a certain pair for a more accurate forecasting.

Starting grid bots at the right moment, with the best pairs possible, can really impact how much you make in aggregate after a certain term of 30 days or 1 year after running multiple bots.

Bitsgap is an external tool so you will need to connect to your crypto exchange of choice by using APIs keys giving you a lot of control, but also adding up costs of the tool itself, plus trading fees.

By using API keys the bot can only execute the actions you allow it to. In this case trading, making it very safe as long as there are no problems with your exchange.

Pionex [low cost & plenty of bots]

If you are just starting out with low funds to invest on the bots, then consider using Pionex instead of Bitsgap.

The only thing you will be paying here are trading fees which are even lower than Binance itself. There’s no fixed subscription fee like the previous one.

Another reason to use this tool (and the most important one), is that you can use more grids on Pionex than on other bots with the same or lower investment amounts.

This is possible because the platform aggregates trading volume from both Binance and Huobi which are two of the biggest crypto exchanges in the world ranked by volume.

On the flip side you would need to deposit funds on it just like on any other crypto exchange to start trading, create bots or use any other investment products.

And if you watch this video about grid bot settings, you will understand that it is usually better to run bots with around 100 grids to keep making profits even if there’s less volatility at any given moment!

It’s a great unified platform which tries to combine the best aspects of exchanges and trading automation in one simple app or website.

Bituniverse [free alternative]

Bituniverse is like a child company from pionex which still allows you to run grid bots although with less advanced features.

You can even sign up using the same credentials for both Pionex and Bituniverse if you really wanted to.

It tries to be a free no strings attached option, but allows you to use less grids, and there are only grid bots.

So it ends up being quite a simplistic but functional option for beginners. Don’t expect to find settings such as take profit or trailing either.

Bituniverse still uses API keys to connect with your exchange, which means full control over permissions.

Binance Spot Grid [simple exchange bot]

Grid bots are not limited to external software. If you are a client on certain exchanges some will already have trading bots built-in.

Binance grid bots are called Binance Spot Grid bots. The core functionalities are all there and the simplicity of opening your exchange and doing everything from there is very convenient.

However you might pay higher fees if you don't hold BNB (Binance Coin) and the backtesting capabilities and bot pairs ranking system is not that great to find the best coins.

But the fees situation is also true for regular trading and usually has a more significant effect on users who trade a lot on a short time frame, and your bot might just do that if you have a lot of grids!

KuCoin Spot Grid [another exchange bot]

KuCoin is also a great option for exchange trading bots, and they do also have a spot grid bot which doesn’t require enormous amounts of initial investment. Provided that you will use less grids on it.

They do have a ranking system to see some of the best performing grid bots running on the past few days and a rank to sort coins by volatility just like Pionex.

And there are also AI recommended settings you can use, although they are not as good as Bitsgap or Pionex.

I don’t generally recommend you blindly follow those as past performance doesn’t always correlate with future performance.

That’s why there must be a strategy behind running grid bots, instead we try to pick pairs according to price action, patterns in the chart and the risk level it would represent.

What Bot Should You Use?

I recommend Bitsgap due to its backtesting ranking where you can easily spot good pairs to run bots. And those pairs might even make you extra profits with price increases.

While the other bots on the list are also very good they lack a bit in the Pair Ranking department.

All of them have a list view of coins based on market cap, gainers, losers and other criteria. But so does Coin Geko and CoinMarketCap, which are simple sites where you can list and find coins.

They also have some kind of backtesting function but it is not as accurate, detailed and easy to use on your own bots as it is on Bitsgap!

Pionex would be my second recommendation! The mobile app is very well put together, fees are low, you can run more grids with less money and there are a lot of bots. The only trade off is that you will need to transfer your funds to their platform.

If you simply want to run in-house trades and have plenty of funds I would just stick with the Binance Spot Grid Bot.